SAVE THE FUTURE

a long-termism experiment

It is widely understood today that the current economic paradigms of growth and industrialisation need to shift towards a more inclusive and sustainable way of thinking. We need a new system that addresses growing inequalities in society, accounts for negative externalities, such as environmental pollution, and that explores new types of governance, for example through empowering citizens in decision making.

A key component in this transition is a shift from valuing short-term gains and profits towards long-term thinking that includes the next generations’ wellbeing, too. In 2019, EIT Climate-KIC, Europe’s leading climate innovation initiative, launched a series of new large-scale projects, so-called ‘Deep Demonstrations’, to explore systems innovation for a greener, net-zero future. The portfolio of interventions includes education, citizen engagement, finance, policy and other levers of change that catalyse fast decarbonisation. Out of the eight Deep Demonstrations currently in operation, one is called the Long-termism project. In it, eleven expert partners focus on changing mindsets and explore ways to stimulate long-term thinking. To foster long-term oriented behaviours, mindsets, and action, they are trying to answer a set of questions. For example: ‘What new types of governance and rule-setting are needed to redesign institutional structures?’, ‘Can frontier technological prototypes be used to redefine our notions of value?’, ‘How can we use the power of collective movements to democratise rulemaking?’ and ‘In what way can data transparency and capacity building empower individuals?’.

Enabling collective action and opening new democratic spaces can create a groundswell of pressure for change. One way of doing this is through social and economic experimentations, for example in the form of social simulations. Social Simulations combine game elements with systems analysis, role playing, and simulation techniques. This way, they allow players to experience hypothetical events and scenarios. In this blog post, I introduce SAVE THE FUTURE. It is a simulation that seeks ways to transform the financial system by exploring alternative notions of value. For example, it employs ‘green tokens’ as a complementary currency. The simulation was developed for EIT Climate-KIC’s Long-termism project and has been tested and further improved by project partners and volunteers.

Alternative currencies for long-term thinking

Our current monetary system systematically encourages unsustainable behaviour patterns and threatens social and environmental sustainability. Because bank-debt money carries interest, the discounting of future costs and incomes inevitably leads to short-term thinking, as Bernard Litaer explains in the Club of Rome – EU Chapter report on money and sustainability. The process of compound interest (interest on interest) imposes exponential growth on the economy, which is, by necessity, unsustainable in a finite world. Furthermore, the set-up of our current financial system fosters wealth concentration and an increase in inequality. We need to re-think and shift the discourse around ‘money’. We need to empower individuals to recognize the current monetary system as a systemic cause for short-termism, inequality, and unsustainability. One popular, practical solution to this problem is complementing the prevailing monetary monopoly with a ‘monetary ecosystem’. The information and communication revolution that we are experiencing today, with innovations like the blockchain technology, can help us in this. Because they are open-source, such technologies prove it is possible to create pressure for change by enabling pioneers to take collective action and create alternative designs. ‘Emerging democratic socio-ecological money system(s) empower individuals by offering mechanisms for adequate resource allocation and behaviour change aligned with incentives.’ says Dr. Marcus Dapp, a cryptoeconomics expert at ETH Zurich and one of our Long-termism project partners. Although such a solution profoundly challenges the dominant fiat currency system, it can grow independently through addressing daily challenges faced by communities. For instance, it could adjust resource allocation to local needs. Over time, it could become a self-sustaining, resilient, less manipulable network of digital money and assets.

Within the Long-termism Deep Demonstration, the Centre for Systems Solutions developed the policy simulation SAVE THE FUTURE as a tool for testing various institutional and policy solutions that could be combined into an alternative, more sustainable and long-term focused financial system. The simulation is set in a stylized world, where players (divided into government, investors, and entrepreneurs) make choices about industrial investments, international trade, social development, and environmental management. In the process, they try to balance their own short-term goals with such long-term consequences for their country and surrounding lands as water pollution or wasteland creation. The simulation introduces new economic ideas, such as alternative currencies, to explore if and how they would shape the economic choices of participants.

Implementing a ‘green currency’

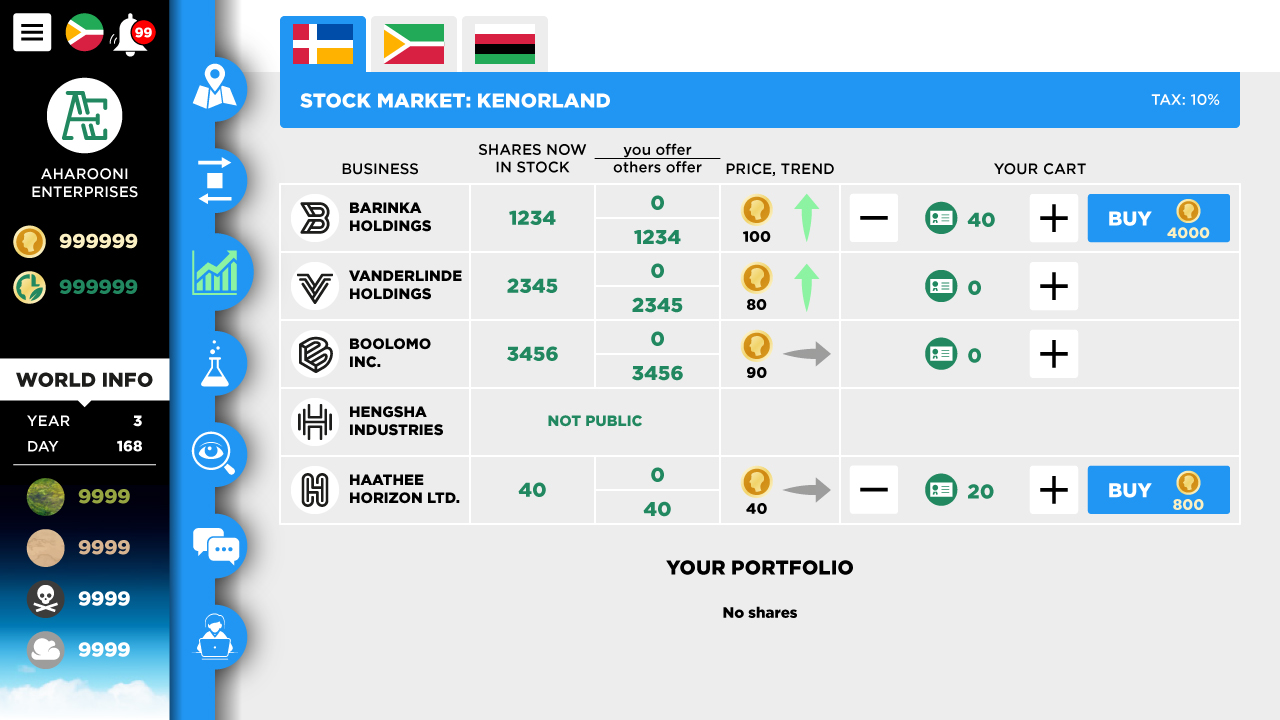

SAVE THE FUTURE includes two countries, Kenorland and Vespugia. The countries have a conventional currency but can introduce, through their government players, a green, alternative one. The alternative currency design in the simulation is inspired by existing complementary currencies, such as the ECO, which mobilise resources in order to reduce climate change impact and support sustainable behaviour. The green currency is a token currency, complementary to the conventional one. Its goal is to shift the players’ behaviour towards more sustainable actions, such as wasteland regeneration. The green currency in SAVE THE FUTURE is implemented by the national government and can be compared to an environmental tax or a green subsidy. The government player is able to raise and decrease the costs and benefits of certain actions that are or need to be paid for in green currency. The alternative green currency is tied to the country’s currency in a ratio of 1:1. In any operation where alternative currency is allowed, the system first tries to use this alternative currency and in the second step complement it with the regular currency. Actions that generate green currency, which is then paid out to players, include wasteland regeneration, closing a pollution facility, starting a clean tech facility, or investing in R&D in clean technologies. Actions that lead to the removal of green currency tokens from the players business accounts are pollution, GHG emissions, natural area removals. Each entity (businesses, investors, or government) has an additional account for the new, green currency. The government can decide on its own whether to accept taxes in the alternative currency. Likewise, each organization (businesses and investors) can decide whether to accept payments in the alternative currency. To give players the opportunity to experience the value of alternative currencies, the game is divided into two periods: In the first part, there is only one currency. As entrepreneurs build facilities, pollution increases, wastelands spread, water gets contaminated, and wellbeing in the cities decreases. Then, the game is paused, and all players are called into a ‘town hall meeting’ on Zoom to discuss the current economic and environmental situation. The game moderators reveal the option to introduce an alternative, green currency. The players decide if the government should introduce it. In the second part of the simulation, players can experience how the introduction of a green currency changes the economy and the behaviour of the players.

The simulations conducted so far show that people take greater care of wastelands after the green currency, which enables profiting from environmental restoration, is introduced. The simulations revealed clearly that alternative currencies and their design do influence our behaviour in a desired way. We should take advantage of this discovery and use money and the financial system to help us transition towards a net-zero emission future.